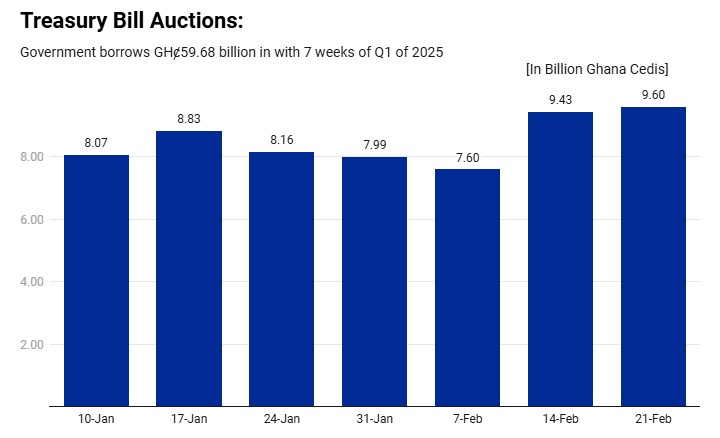

rowed in seven weeks from the domestic money market through the issue of 91-day, 182-day, and 365-day Treasury Bills.

The new Mahama-led government’s borrowing from the domestic short-term market in 2025, also known as Treasury Bill Auctions, started right at the beginning of the year, upon the government’s assumption of office. This borrowing has spanned seven consecutive weeks.

According to Bank of Ghana data, the government first accessed the domestic market on January 10, 2025, three days after assuming office, and borrowed GHȼ8.07 billion. Another round of borrowing on January 17, 2025, raised GHȼ8.83 billion.

The borrowing trend continued weekly:

- January 24, 2025: GH₵8.16 billion

- January 31, 2025: GH₵7.99 billion

- February 7, 2025: GH₵7.60 billion

- February 14, 2025: GH₵9.43 billion

- February 21, 2025: GH₵9.60 billion

This significant borrowing signals the government’s reliance on short-term domestic financing to manage its fiscal needs. Analysts are monitoring the trend to evaluate its impact on economic stability, interest rates, and private sector liquidity.